SUBMIT YOUR DETAILS FOR

It all started with a nagging feeling. You know that one, right? That little voice in the back of your head whispering that something just isn’t quite right with your money. For me, it was the constant anxiety of never having enough, of living paycheck to paycheck despite working hard. I’d see friends buying houses, taking vacations, and I’d be stuck wondering where my money went. It felt like a never-ending cycle of earning and spending, with no real progress to show for it. This persistent unease finally pushed me to seek a solution, and that’s when I stumbled upon the world of the CMA Report.

Now, if you’re anything like me a few months ago, the term "CMA Report" might sound like some arcane financial jargon, something only accountants or business tycoons understand. Trust me, I was there. I pictured complex spreadsheets, endless columns of numbers, and a language I definitely didn’t speak. But as I delved deeper, I realized that the CMA Report, in its essence, is a powerful tool for understanding your financial health, and it’s far more accessible than I initially imagined. It’s not about being a financial genius; it’s about gaining clarity.

Let me tell you, my first encounter with the concept of a CMA Report wasn’t in a stuffy office with a stern-faced advisor. It was actually during a casual chat with a friend who’d been through a similar financial struggle. She was talking about how she finally got a grip on her finances, how she knew exactly where every dollar was going, and how she was finally starting to save. Naturally, I was intrigued. "How did you do it?" I asked, probably a little too eagerly. She mentioned something called a "CMA Report" and how it was a game-changer for her. My curiosity was piqued, and thus began my own journey.

Unpacking the Mystery: What Exactly is a CMA Report?

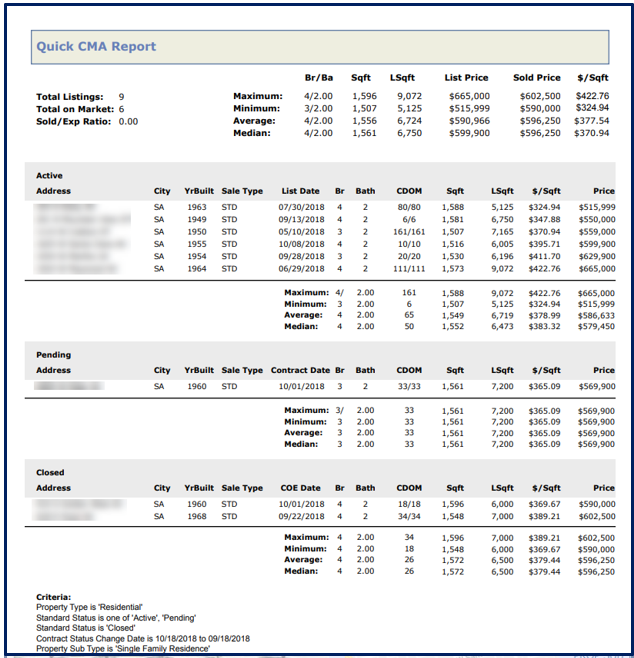

So, what is this magical CMA Report? CMA stands for Comparative Market Analysis. Now, that might still sound a bit intimidating, but let’s break it down into simpler terms. Think of it as a financial snapshot, but not just of where you are right now. It’s a comparison. It compares your current financial situation to similar situations or benchmarks. In the context of personal finance, it’s about understanding your spending habits, your income, your debts, and your assets, and then seeing how they stack up.

Imagine you’re trying to sell your house. You’d look at what similar houses in your neighborhood have sold for, right? You’d compare their features, size, and condition to yours to get an idea of its market value. A CMA Report does something similar for your finances. It helps you understand your financial "market value" by comparing your financial data against established norms or even your own past performance.

In the world of real estate, a CMA Report is prepared by a real estate agent to help sellers price their homes competitively. They look at recent sales of comparable properties, properties currently on the market, and even expired listings. This data helps them determine a realistic selling price. For personal finance, the "comparable properties" are essentially your own financial behaviors and patterns, and sometimes, even broader economic indicators or typical spending habits for people in similar income brackets.

My First Dive: The Personal Finance CMA

My friend explained that for personal finance, a CMA Report isn’t a single, standardized document like you’d get from a real estate agent. Instead, it’s a process of gathering and analyzing your financial information to create a clear picture. It involves looking at several key components:

- Income: This is the money coming in. It’s not just your salary; it includes any other sources of income like freelance work, investments, or benefits. Understanding the net amount you bring home after taxes is crucial.

- Expenses: This is the money going out. This is where most people, including myself, tend to struggle. It’s not just the big bills like rent or mortgage; it’s also those daily coffees, impulse buys, subscriptions you forget about, and dining out. The CMA Report forces you to categorize and quantify all of these.

- Assets: These are things you own that have value. This could be your savings accounts, investments (stocks, bonds, mutual funds), real estate, and even valuable possessions like cars.

- Liabilities: These are your debts. This includes mortgages, car loans, student loans, credit card balances, and any other money you owe.

The "comparative" aspect comes in when you start analyzing this data. You compare your spending in different categories to your income. You compare your debt levels to your assets. You might even compare your spending on certain items (like entertainment or dining out) to what you intended to spend, or what you see as a reasonable amount.

The "Aha!" Moment: Discovering My Spending Black Holes

When I first sat down to do this, it was… humbling. I had a vague idea of where my money went, but seeing it all laid out was a shock. I used a simple spreadsheet initially, which felt a bit like building my own rudimentary CMA. I meticulously tracked every penny for a month. Every coffee, every online purchase, every grocery run.

The results were eye-opening. I discovered "spending black holes" I hadn’t even realized existed. For instance, my daily latte habit, which I considered a small, justifiable treat, was adding up to a significant amount each month. Online shopping, fueled by targeted ads and the ease of one-click purchases, was another culprit. I was spending more on impulse buys and convenience items than I was saving.

The CMA process forced me to confront the reality of my spending. It wasn’t about judgment; it was about information. It was like turning on a bright light in a dark room. I could finally see the patterns, the habits that were holding me back from my financial goals.

Beyond Just Tracking: The Analytical Power of the CMA Report

But a CMA Report isn’t just about listing numbers. The real power lies in the analysis. Once I had my income, expenses, assets, and liabilities documented, I started to compare.

- Income vs. Expenses: This is the most fundamental comparison. Was I spending more than I earned? (Spoiler alert: I was, often). This immediately told me where the problem lay.

- Expense Categorization: I looked at where my money was going. Was I spending a disproportionate amount on discretionary items like entertainment and dining out, compared to essential needs like housing and groceries? This helped me identify areas where I could realistically cut back.

- Debt-to-Asset Ratio: This comparison shows how much debt you have relative to your assets. A high ratio means you owe more than you own, which is a clear sign of financial instability. Seeing this number in black and white was a wake-up call.

- Progress Tracking: The "comparative" aspect also extends to tracking progress over time. By creating a CMA Report regularly (say, monthly or quarterly), I could compare my current financial situation to previous periods. Was my debt decreasing? Were my savings increasing? Was my spending under control?

This analytical phase is where the magic truly happens. It transforms raw data into actionable insights. It moves you from "I don’t have enough money" to "Here’s why I don’t have enough money, and here’s what I can do about it."