SUBMIT YOUR DETAILS FOR

You know, when I first heard the term "co-ownership," it sounded a bit like a fancy legal jargon, something you’d only find in dusty law books or whispered about by seasoned investors. But life, as it often does, has a funny way of throwing you into situations you never quite anticipated. For me, that situation involved a charming, albeit slightly neglected, beach cottage and a dream shared with my best friend, Sarah.

We’d spent countless summers at this very spot, renting the same little cottage year after year. It was worn, a little creaky, but it held a special kind of magic. The salty air, the sound of the waves lulling you to sleep, the endless sunsets painting the sky – it was our sanctuary. One particularly memorable evening, after a bonfire and a few too many s’mores, Sarah, with a glint in her eye, said, "You know, we should just buy this place."

My first thought was, "Dream on, Sarah." Buying property, especially a vacation home, felt like a monumental task, a financial Everest I wasn’t sure I could even begin to climb. But then, the seed was planted. We started talking, really talking, about the possibilities. And that’s when co-ownership entered my vocabulary, not as a dry legal concept, but as a potential pathway to making our shared dream a reality.

So, what exactly is co-ownership? In its simplest form, it’s when two or more people jointly own a property. It’s not just about sharing the cost; it’s about sharing the responsibility, the joy, and yes, sometimes the headaches. For Sarah and me, it meant pooling our savings, figuring out how to split the mortgage payments, and deciding who would be responsible for what when it came to maintenance.

The initial conversations were a mix of excitement and apprehension. We were best friends, practically sisters, but this was a whole new level of commitment. We sat down, armed with notebooks and an alarming amount of coffee, and started to map out our vision. We talked about how we’d use the cottage: would it be just for us, or would we consider renting it out sometimes? What if one of us wanted to sell their share? These were crucial questions, and the answers would form the bedrock of our co-ownership agreement.

This is where the "trust" part of my initial thought comes into play. Co-ownership thrives on trust. You have to trust the other person to uphold their end of the bargain, to be responsible, and to have the same ultimate goal in mind. Thankfully, Sarah and I had a foundation of trust built over years of shared experiences. But even with that, putting it all down in writing felt essential.

Our lawyer, a kind woman named Mrs. Henderson, guided us through the process. She explained the different types of co-ownership. The most common ones are joint tenancy and tenancy in common.

Joint Tenancy is a bit like a marriage in property terms. When one owner passes away, their share automatically goes to the surviving owner(s). It’s a seamless transfer. This sounded appealing, but it also meant we had less control over what happened to our share if something unexpected occurred.

Tenancy in Common, on the other hand, allows each owner to hold a distinct, undivided interest in the property. This means each of us could decide who inherits our share. This felt more flexible and gave us greater control over our individual interests. We opted for tenancy in common.

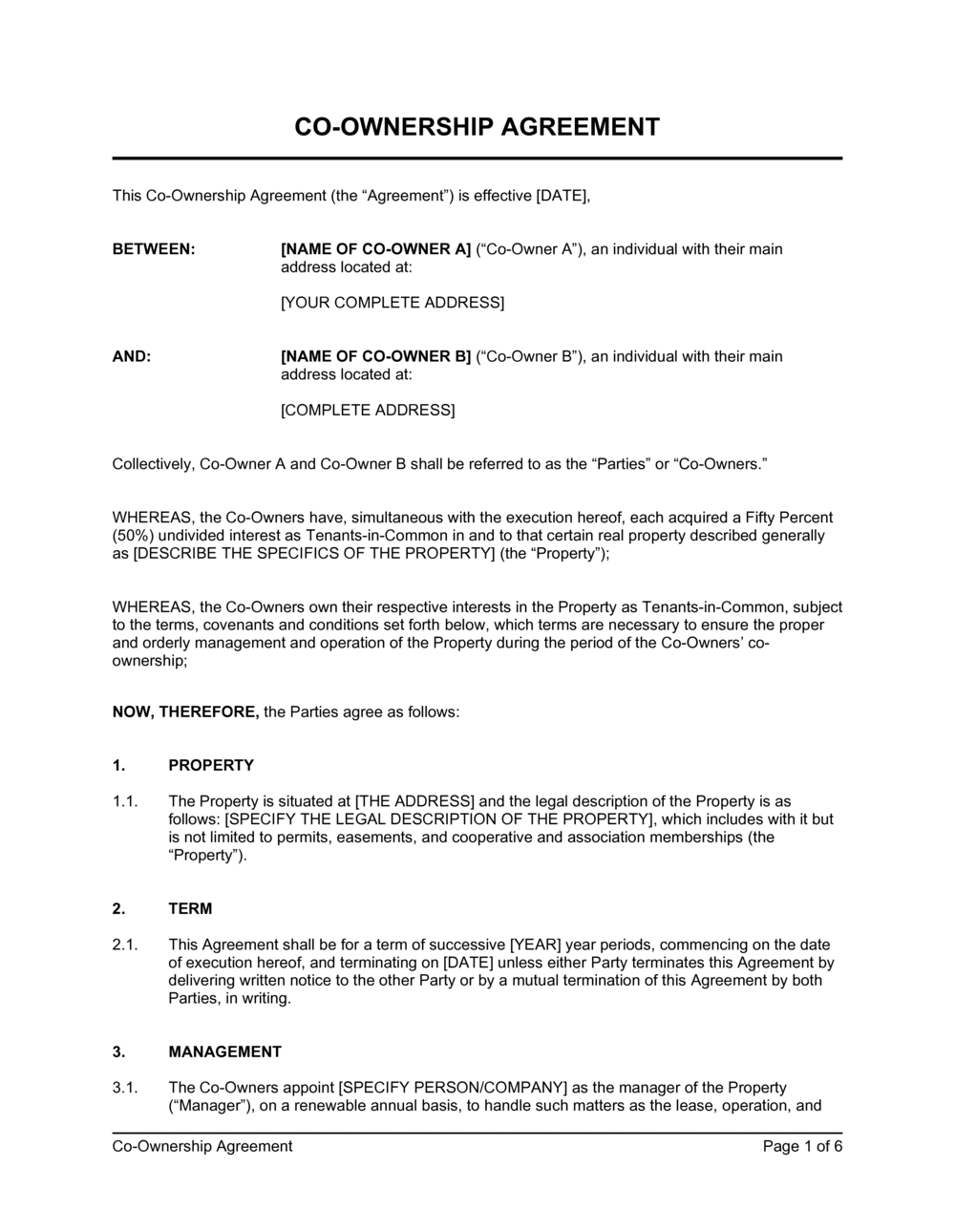

We also discussed the importance of a Co-Ownership Agreement. This isn’t just a formality; it’s the rulebook for our shared ownership. It’s where we documented everything:

- Ownership Percentages: How much of the property each of us owned. For us, it was 50/50.

- Financial Contributions: How mortgage payments, property taxes, insurance, and any future repairs or renovations would be split.

- Usage and Access: How we would schedule our time at the cottage, especially during peak seasons. This was a big one! We learned to compromise and be flexible.

- Decision-Making: How major decisions would be made (e.g., selling, renting, significant renovations). We agreed that for anything substantial, it would require a mutual agreement.

- Exit Strategy: What would happen if one of us wanted or needed to sell their share. This included how the property would be valued and the process for buying out the other owner. This is arguably the most critical part of the agreement, ensuring a clear path forward if circumstances change.

Putting it all in writing felt a little daunting at first. It felt like we were anticipating the worst. But Mrs. Henderson explained that a well-drafted agreement isn’t about expecting failure; it’s about ensuring clarity and preventing misunderstandings down the line. It’s about protecting both parties and preserving the friendship.

The actual purchase was a whirlwind. There were inspections, appraisals, and a whole lot of paperwork. But having Sarah by my side made it feel manageable. We celebrated the closing with a champagne toast, the keys to our very own beach cottage finally in our hands.

The first few years were idyllic. We’d coordinate our visits, leaving notes for each other about local recommendations or funny anecdotes from our stays. We tackled some minor renovations together – a fresh coat of paint, new outdoor furniture. It was a true collaboration, and the cottage slowly transformed into our shared vision.

There were moments, of course, when our different preferences emerged. Sarah loved to have the windows wide open, even if it meant a bit of sand blowing in. I, on the other hand, preferred a more controlled environment. We’d have gentle discussions, often over breakfast with the sound of the waves as our soundtrack, and find a compromise. Sometimes it meant one of us yielding, other times it meant finding a third way.

One significant challenge we faced was unexpected. A major storm hit the coast, and our beloved cottage sustained some damage. This was a test of our co-ownership agreement and our relationship. The insurance payout wasn’t enough to cover all the repairs. This is where our financial contributions section of the agreement became vital. We had to decide how to cover the shortfall. It meant dipping into our personal savings again, but because we had planned for such contingencies, the decision was straightforward, albeit a little painful financially.

This experience reinforced the value of having a clear, written agreement. Without it, this unexpected expense could have led to arguments, resentment, and potentially jeopardized our friendship and our ownership. We revisited our agreement, discussed how we’d manage the repairs, and set up a plan for replenishing our savings.

Another aspect of co-ownership that I’ve found incredibly rewarding is the ability to achieve something together that might have been out of reach individually. The financial burden is shared, making a significant investment more accessible. For Sarah and me, owning this cottage wasn’t just about having a place to escape; it was about creating lasting memories, a legacy we could share and pass down.

The flexibility of co-ownership is also a huge draw. If, for example, one of us needed to step back for a period due to personal circumstances, the other could continue to manage and enjoy the property, with the agreement outlining how that would work financially. It’s a partnership that can adapt to life’s changes.

When it comes to selling your share in a co-owned property, this is where the exit strategy becomes paramount. Our agreement stipulated that if one of us wanted to sell, we would first offer our share to the other co-owner. The price would be determined by an independent appraisal. This prevents a stranger from becoming a co-owner without the other’s consent and ensures a fair price. If the other co-owner couldn’t or didn’t want to buy, then we would be free to sell our share on the open market, but any new buyer would essentially step into our shoes and become a co-owner under the terms of our existing agreement.

Key Takeaways for Aspiring Co-Owners:

If you’re contemplating co-ownership, whether it’s a vacation home, an investment property, or even a primary residence with a partner or family member, here’s what I’ve learned: